-

the cyclical economy and consumer

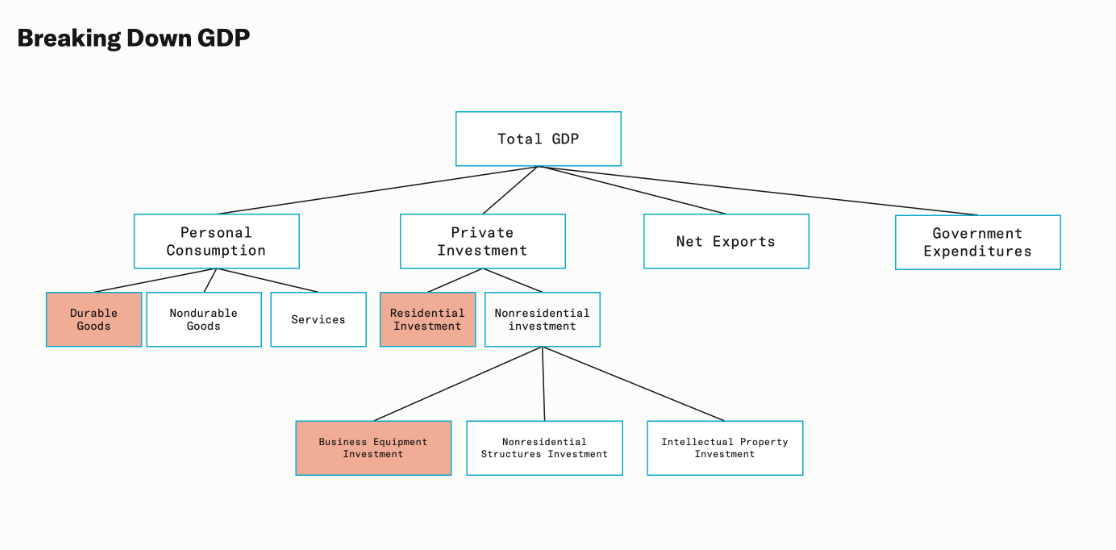

Dec 06 ⎯ Digesting content from EPB research Changes in the economy stem from a few select categories that contribute to GDP. EPB argues that these three components are the most sensitive to change and other areas of the economy tend to be more sticky/stable. Durable Goods Consumption Residential Investment Business Equipment Investment The consumer spend patterns worth keeping an eye on are just durable goods. The cyclical GDP components swing the most. 80% of the non-cyclical GDP items never contract. It makes some sense to me that these categories are most flexible to change in spending ability of the market. Durable goods like vehicles, refrigerators and long-term items tend to be higher ticket (in dollar value) and consumers are ready to delay this spend in a down-turn. This also applies in a business context where capex items - like heavy machinery, functional equipment and other pp&e is delayed during weakening business conditions. Where to look for signals Financial performance and balance sheet of large cap companies selling durable goods ABS data - housing, autos and capex in general Where are we at today on the consumer? Durable goods spending is flattening through 2025. BNPL purchase volume surges in America as Affirm and Klarna’s U.S. GMV both jump 43%, with consumers turning to installments amid financial strain. Klarna recently secured a $6.5B loan to expand further. Chipotle, Dominos, other QSR restaurants hurt in recent earnings - citing consumer issues in younger demographics. We believe that this guest with household income below $100,000 represents about 40% of our total sales and, based on our data, is dining out less often due to concerns about the economy and inflation. A particularly challenged cohort is the 25 to 35-year-old age group. We believe that this trend is not unique to Chipotle Mexican Grill, Inc. and is occurring across all restaurants as well as many discretionary categories. This group is facing several headwinds, including unemployment, increased student loan repayment, and slower real wage growth. We tend to skew younger and slightly over-indexed to this group relative to the broader restaurant industry. “There’s also a little bit still that bifurcation of the U.S. consumer economy. We have been speaking about it for several quarters now that the top end does much better than the lower end income segments in the U.S. So that’s overall, I think, the picture.” – Booking (BKNG 3.11%↑) CFO Ewout Steenbergen

-

weekly snippets #1

Nov 16 ⎯ Metrics https://www.thetwentyminutevc.com/everett-randle - Ev makes some good points around performance measurement in the AI era. COGs: The common frame from SaaS era investing is to see companies with high gross margins of c.80% as an indicator of health. AI companies are seeing much lower GM % (c.50% or less) as the inference spend is still high on a relative basis. Doesn’t mean it’s a bad business. The second order benefits of lower GM is potentially higher gross profit dollar per customer - simply AI companies command greater spend. He argues that this is visible in the cloud spend line items as well. I agree the desire around high COGs is a blunt tool - consider the enterprise software company that has onboarding charges, the incremental (year 2,3,4+) gross margin per customer is far higher once you strip out the initial loaded implementation. Doesn’t mean that a static one-year GM% <60% is a cause for concern. Revenue Retention - This week we looked at an investment where there was a stark difference between the overall annual view of NRR vs monthly cohorted view. We were seeing monthly cohorts churn to c.85% NRR after 12 months despite showing annual net retained numbers north of 100%. It’s a good reminder to consider the differences of each methodology. Annual snowballs measure the over time diminishment (or expansion) of your revenue base with a starting number that contains many old vintages of customers. What happens over time to show this difference is - if you have an incredibly sticky set of long term customers, those might eventually become healthy expansion cohorts. You may be signing on a large batch of new customers. The monthly cohorts lifted over a 24 month period, suggesting that early batches had segmentation and ICP mix problems. The other issue in this business was that new customers weren’t growing fast enough for there to be enough of a drag on churn or downsell - vs the expansion from old customers coming through. Zoetis Bullish ZTS at current price levels. Trading at all time low PE c.19 and EV/fwd EBITDA of c.15x (10Y average is c.23x) High quality business. 40% margins that have always grown in spite of competition ROIC >20% Number 1 player across multiple categories Underlying fundamentals are strong. US pet adoption is already high but there are growth in product categories like Dermatology and Pain to drive revenue. Continue to see underlying market growth rates at c.6% (driven by the humanisation of pets and general shift towards pet ownership in developed economies). Brazil, China and Europe are all very large markets with more companion animals than the U.S. and are very early in ZTS penetration. Market seems to be worried about macro and competition. My view is that it’s all short term headwinds that are temporary and ZTS has levers to play with to drive growth/compete Macro: consumer discretionary health might impact new revenue growth slightly due to vet visits but overall demand is sticky (healthcare) and will tick up agaain. Competition: my view is that short-term pain can be competed against, Elanco is operating on 57% vs 70% gp margins and 20% EBITDA vs 40% EBITDA margins which suggests to be that Zoetis is nowhere near a scenario where they can’t defend their share. Reflections Where I want to be in 3 years time - inverting from the top to plug gaps in my skillset. Areas to work on: 1) Network 2) Dealflow and 3) Leadership.

-

My first post

Nov 11 ⎯ hello world